Top Tips for a Smooth and Stress-Free Home Sale

Selling a home is considered more stressful than planning a wedding. Yes, you read that right! According to a recent study by Opendoor, selling a home is 35% more stressful than planning to exchange vows. And for many homeowners aged 55 and over, selling a home is often intertwined with major life transitions, adding another layer of emotional complexity. This statistic might surprise some, but it highlights the significant emotional and logistical hurdles involved in selling a property. Whether you're downsizing, relocating, or simply embarking on a new chapter, understanding the potential stressors and planning effectively can make a world of difference. Why is Selling a Home So Stressful? Among 55+ Americans, selling a home (65%) ties with starting a new job (65%) as the most stressful life events. These events are considered more stressful than buying a home (62%) and planning a wedding (48%). Women in this age group find home real estate transactions significantly more stressful than men, with 72% of women citing selling a home as the most stressful event compared to 57% of men. Here are just a few of the reasons selling a home can be overwhelming: Emotional Attachment Homes are more than just structures; they hold memories and sentimental value. Of those surveyed, 66% feel attached to their homes, and 56% have lived in their homes for 15 years or more. This makes leaving a home a bittersweet mix of emotions, making the selling process emotionally taxing. Uncertainty and Financial Pressure Selling a home involves many uncertainties, such as finding a buyer, negotiating prices, and dealing with market fluctuations. The financial stakes are high, and the pressure to get the best deal can add to the stress. Coordination of Logistics From staging and showing the home to handling paperwork and moving logistics, the process requires meticulous planning and coordination. This can be overwhelming, especially for those who are also juggling other life responsibilities. Tips for Managing Home Selling Stress Understand Your Selling Options Knowing your options and planning ahead can significantly reduce the stress of selling a home. Partnering with a real estate professional allows them to handle marketing, negotiations, and paperwork—not to mention an average of $34,000 more in profit, according to a recent study. Another option is iBuyers, which is when companies buy homes directly. These often offer a fast and convenient sale, though offers are typically lower than a traditional sale. Selling yourself (FSBO) requires a significant effort in marketing, negotiations, and legal aspects. This can save on agent commissions, but typically results in a lower sale price. Set Realistic Expectations Understanding the current market conditions and setting realistic expectations can prevent disappointments. Today’s market is not like the one in 2021-2022! If working with a professional, discuss your goals with your real estate agent and be prepared to make changes based on what’s happening locally.

Read More

America's Favorite Long-Term Investment: Why So Many Love Real Estate

When it comes to long-term investments, Americans have a clear favorite: real estate. According to a recent Gallup poll, 36% of Americans believe real estate is the best long-term investment, outpacing stocks (22%), gold (18%), savings accounts (13%), bonds (4%) and cryptocurrencies (3%). Why is that the case? Let’s dive into why so many people believe that owning property is the ultimate way to build wealth over time. The Popularity of Real Estate as a Long-Term Investment For 11 years running, real estate has consistently topped the list of preferred long-term investments in Gallup’s annual Economy and Personal Finance survey. " alt="" /> This preference for real estate is driven by several factors: Tangible Asset: Unlike stocks or bonds, real estate is a tangible asset that you can see and touch. This physical presence provides a sense of security that is hard to match. Appreciation Over Time: Historically, real estate values have shown steady appreciation. From the 1990s to the 2020s, home prices have consistently increased, making real estate a reliable investment. Dual Benefits: Owning a home provides not only potential financial returns but also a place to live. This dual benefit is unique to real estate and adds to its appeal. Gallup’s poll found this preference holds true across all income levels, with 33% of lower income households stating they believe real estate is the best long-term investment, along with 36% of middle income households and 40% of upper income households. Real Estate vs. Other Investments While real estate is the top choice for many, it’s important to consider how it stacks up against other investments. Stocks, for example, have historically offered higher returns. From 1990 to April 2024, the S&P 500 surged by 1,325%, while the S&P CoreLogic Case-Shiller U.S. National Home Price Index rose by 308%. However, stocks come with higher volatility. Real estate, on the other hand, tends to provide more stable growth. Even during economic downturns, such as the Great Financial Crisis of 2008, real estate has shown resilience and recovery. This is highlighted when you look back at U.S. home price growth by the decade U.S. home price growth by decade: 1990s: +30.1% 2000s: +47.3% 2010s: +44.7% 2020-2024: +47.1% Locally, home prices have risen XX% over the past year, and XX% since 2020. Is Real Estate the Right Investment for You? Real estate can be a fantastic long-term investment, especially in a growing market like [Market]. But before diving in, consider your individual situation: Long-Term Commitment: Buying a home is a long-term play. If you plan to move in a few years, it might not be the best fit. Financial Strength: Real estate requires a down payment, closing costs, and ongoing maintenance expenses. Make sure you have a solid financial foundation. Investment Goals: Consider your overall investment goals. If you prioritize high returns and easy access to your money, another investment might be a better fit. And keep in mind that diversification leads to a balanced investment strategy. Financial experts recommend spreading investments across various assets to hedge against different market forces and increase the odds of a net profit over the long term. This means integrating real estate within a broader portfolio that includes stocks, bonds, and other investment vehicles. Bottom line: While poll results show that Americans prefer real estate as a long-term investment, there is no one-size-fits-all answer. Always consult with your financial advisor when planning to invest for your future, as the best option depends on your financial goals, risk tolerance, and investment timeline.

Read More

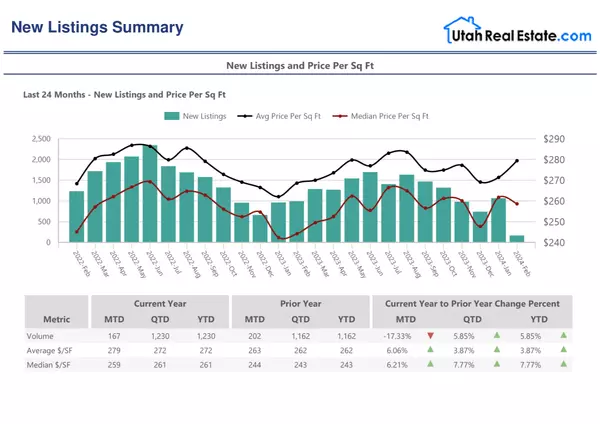

Navigating Market Shifts: A Closer Look at the Decline in New Listings

Greetings, I hope this post finds you in good spirits. Today, I want to share some insights that have recently come to my attention as I analyzed the latest market data. It seems the number of new listings is showing a decline, a trend that's causing me to raise some eyebrows, especially as we transition into the warmer months. One would typically expect an upswing in inventory during this time, thanks to higher rates. However, contrary to this anticipation, the expected increase in new listings has yet to materialize. This deviation from the norm is prompting me to express some genuine concerns about the trajectory we might be headed towards. The persistence of low new listings is not only surprising but also alarming. If this trend continues, there's a tangible fear that we could be witnessing the reemergence of an overheated market. This, unfortunately, could leave consumers - perhaps including yourself - in a less than ideal situation. Staying proactive in times of market uncertainty is crucial. It's essential for us to monitor these shifts closely and be prepared to adapt to changing circumstances. Now, more than ever, is the time for strategic planning and thoughtful consideration of potential challenges that may arise. I invite you to join me in this conversation. Share your thoughts, concerns, and perhaps even your experiences related to these market shifts. Let's navigate these changes together and explore strategies to not only weather the storm but also emerge stronger on the other side. Looking forward to your insights and contributions. Best regards,

Read More

The Federal Reserve's Recent Pause in Rate Hikes: A Positive Turn for the Mortgage Market and Homebuyers

The Federal Open Market Committee (FOMC) plays a crucial role in shaping the economic landscape of the United States by setting interest rates and guiding monetary policy. In its most recent meeting, the FOMC made a significant decision to pause rate hikes, a move that has far-reaching implications for the mortgage market and the broader economy. This blog post will explore the FOMC's decision, its impact on the mortgage market, and the opportunities it creates for prospective homebuyers in the context of a recent upturn in home price reductions. The FOMC's Decision to Pause Rate Hikes The FOMC is tasked with making monetary policy decisions that aim to balance the twin goals of price stability and maximum sustainable employment. One of the primary tools at their disposal is the federal funds rate, which influences interest rates throughout the economy. Throughout 2022 and early 2023, the FOMC raised interest rates as part of its efforts to combat rising inflation. However, in their most recent meeting, the committee decided to pause these rate hikes. Several factors contributed to this decision. First and foremost, the FOMC recognized that the economy had shown signs of slowing down, partly due to the previous interest rate hikes. Additionally, inflation, while still a concern, showed some signs of moderating. By pausing rate hikes, the FOMC aims to provide stability and support to the economy while continuing to monitor inflationary pressures. Positive Impact on the Mortgage Market The FOMC's decision to pause rate hikes has had a significant impact on the mortgage market. Historically, mortgage rates tend to follow the direction of the federal funds rate, meaning that when the federal funds rate rises, mortgage rates also increase. The pause in rate hikes has provided some relief to homebuyers and homeowners looking to refinance. Lower mortgage rates make homeownership more affordable and can boost refinancing activity. This is especially positive news for those looking to enter the housing market or homeowners seeking to reduce their monthly mortgage payments. With lower rates, homebuyers may qualify for larger mortgages, while existing homeowners can save on interest costs through refinancing. Opportunities for Homebuyers The recent uptick in home price reductions, coupled with the pause in rate hikes, presents a unique opportunity for prospective homebuyers. Home prices had been steadily increasing in many markets, making it challenging for many individuals and families to enter the housing market. However, the recent softening of home prices, along with lower mortgage rates, can make homeownership more accessible. Homebuyers can now potentially secure a better deal on their dream homes, as sellers may be more willing to negotiate in a slightly slower market. It's essential for buyers to do their due diligence, get pre-approved for a mortgage, and work with experienced real estate professionals to make the most of this opportunity. Conclusion The FOMC's decision to pause rate hikes represents a significant shift in monetary policy that has a ripple effect throughout the economy, particularly in the mortgage market and the housing sector. Lower mortgage rates and recent home price reductions provide a golden opportunity for homebuyers and homeowners alike. While the FOMC's decision may not be a permanent one, it's essential to seize the moment and make informed decisions in the current housing market to benefit from the positive turn of events. However, as economic conditions can change, staying informed and working with financial advisors can be valuable in making the most of this window of opportunity in the real estate market.

Read More

Categories

Recent Posts